2. Clarify your communications

Give appropriate information at the appropriate time.

Clarity has ever been king. It’s taken on an increased significance with the introduction of consumer duty. It might sound like a semantic trick, but don’t think of this as a burden but an opportunity. A close examination of all your communications can be a real benefit. Increased client understanding leads to increased trust, and ultimately more clients. It really is a win win.

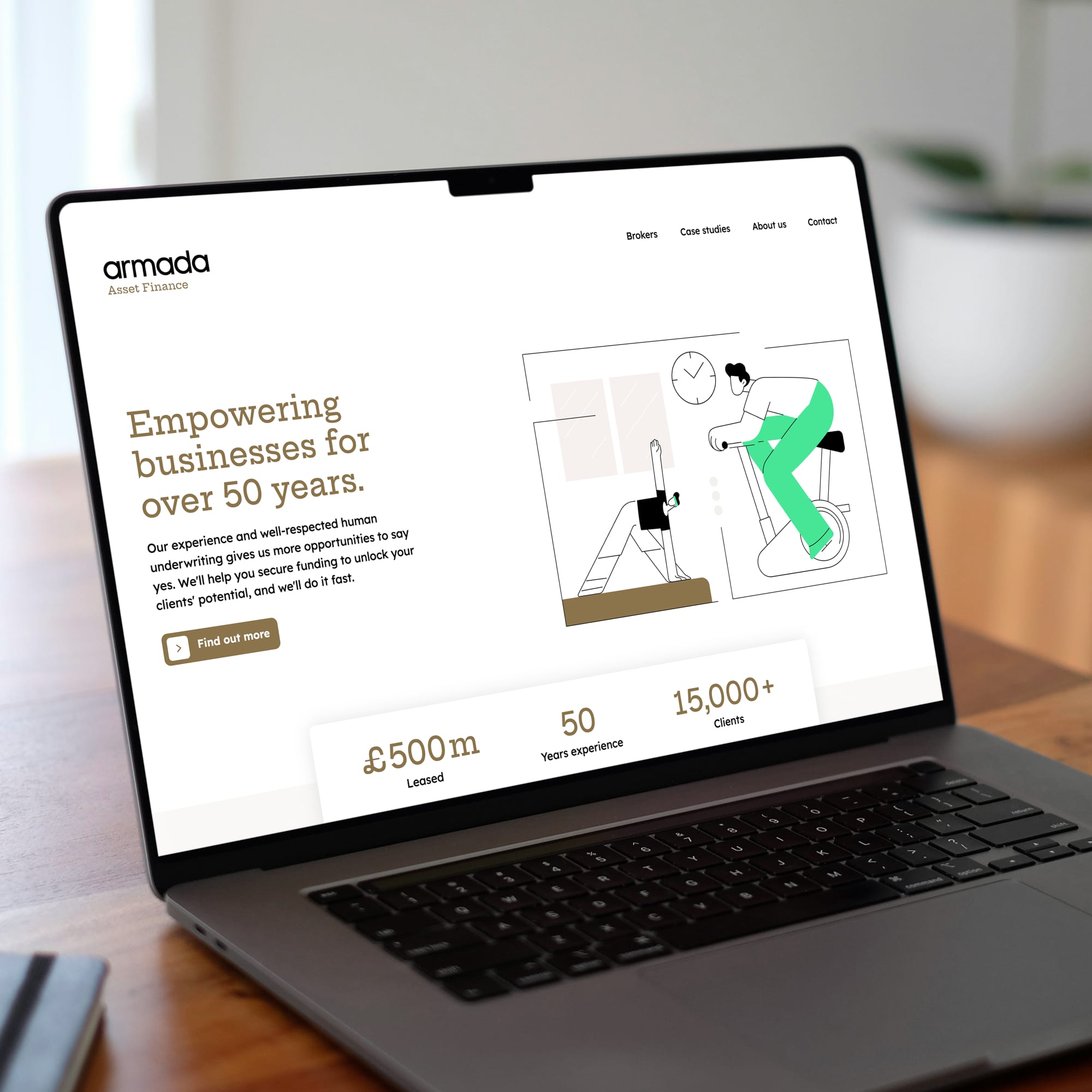

We believe that good outcomes for clients begin at the very first contact. Start as you mean to go on, essentially. First contact will overwhelmingly take place online. Even referrals do their research first. They’ll visit your website. Knowing what to say, and how to say it is vital. Get this right and it’s a key part of your consumer duty evidence.

Consideration should be given too to how, as well as what, is said. Using the same clear and simple language works well for everyone. It doesn’t need to be dumbed down to be understandable. But it does need to be accessible to everyone. In print that means large text and braille. Online it’s screen-readers, alternative text, subtitles for video, etc.

Reputation and clarity are going to make a difference in the sector over the next 10 years or so. Well over £3bn is due to be passed between generations in the coming decade. Research suggests that 9 in 10 financial service providers are worried about the loss of assets. Meanwhile the majority of investors polled said they would seek alternative providers upon receipt of an inheritance.